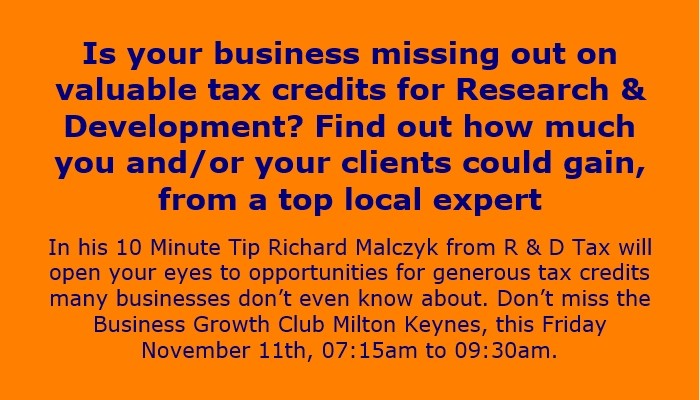

'10 Minute Tip' by Richard Malczyk

An innovation specialist and high-growth business coach with hands-on entrepreneurial, coaching and mentoring skills, holding a proven track record of innovation development success across hi-tech start-up, academic, SME and Blue Chip enterprises.I offer the analytical skills, business acumen and professional expertise that comes with 3 decades of experience in innovation, new product development and strategic marketing across hi-tech businesses such as News Corp, Sky, Tandberg TV, Binatone and NHS Innovations.My approach is pragmatic and my style is hands-on. I believe in building long-term supportive relationships with my clients, seeking to understand their products, markets and business culture with a view to ensuring my services are completely aligned and focused on achieving sustainable business advantage.Specialities: Research & Development Tax Credits, Market Research, Grant funding, Business Development, Business Strategy, Business Start-Up, Strategic Planning, Business Planning, Market Intelligence, Business Warfare, Marketing Strategy, Marketing Intelligence, Market Planning, Product Planning, Product Development, International Marketing, Channel Sales & Marketing, Sales & Marketing Planning, Small Business Grants, Venture Funding. I'm based in Milton Keynes and regularly work in Cambridge, Oxford, Luton, Bedford, Northampton and London.

About the conversation:

Most of us are innovating in our businesses and introducing new products and services. After all, if we didn’t do so, we could end up like Kodak or Blockbuster where the world moves on and leaves us all behind.

But … did you know that the UK Government encourages you to invest in new products and services via Research and Development tax incentives?

These incentives allow you to reduce your annual corporation tax bill or, in some cases, provide extra cash for you to invest in your business.

Despite this, there were only 18,000 R&D Tax claims last year from the UK’s 5 million businesses!

So – what’s going on?

Why don’t businesses know about these schemes?

Why aren’t our accountants proactive in recovering this tax for us?

HMRC has a broad definition of what constitutes “R&D.” Essentially though, it’s about “advancing scientific or technological knowledge or capability”. R&D typically involves a company investing time, effort, talent and resources in attempting to create a new or significantly improved product, process, service, device or material. Secondly, R&D is experimental in nature and involves a degree of uncertainty and financial risk in the outcome – otherwise it’s not R&D. The scheme applies across all industry sectors including, manufacturing, ICT and service businesses.

R&D tax credits are retrospective. In other words, you can apply for them, after having spent time and money on R&D, and you can go back 2 financial years for a first claim. More recently (Nov 2015),HMRC has introduced ‘advanced assurance’ which allows a business that’s about to start major R&D investment to get this ‘pre-approved’ for R&D tax credits by HMRC.

You can typically claim back between 20 and 33% of your eligible R&D costs. This depends on your business’s profitability (R&D tax credits are a credit against corporation tax that you owe, so if you’re not profitable and therefore not paying corporation tax, then HMRC will pay you cash!) I will show some worked examples during the talk.

R&D tax credit claims are retrospective. That means R&D projects which already have happened or are in progress. HMRC doesn’t interfere in the progress of R&D projects but may choose to visit a company if they suspect foul play or misrepresentation.

You need to submit a technical justification of the R&D work undertaken along with associated costs as part of your overall CT600 corporation tax return. As soon as HMRC has approved the claim (usually within 4 to 5 weeks of submission) you can use funds reserved for corporation tax for other things. It’s possible to claim back R&D tax credits every financial year, so companies familiarised with the scheme actively track all their R&D costs and activities in order to simplify the R&D tax credits claim after year end. It’s important to keep accurate records as HMRC can go back 6 years beyond current financial year in the event of an HMRC investigation.

If that sounds complex? Help is at hand. Don’t miss this 10 Minute Tip at the Business Growth Club Friday November 11thto find out more, and how Richard Malczyk and his colleagues at R and D Tax can help you.