'10 Minute Tip' by Paul Wildman - Financial Adviser - 7am to 9:30am

Paul Wildman from MWealth is an experienced financial services professional, providing bespoke financial solutions to individuals, business owners, corporate executives and contractors.

Paul offers a personalised service to all his clients to develop long-term relationships, build and preserve their wealth and protect them against risk.

MWealth is a Partner Practice of St. James's Place Wealth Management. That gives Paul access to over one hundred in-house experts covering all aspects of financial planning. This includes personalised tax solutions, Inheritance Tax planning advice, income and retirement strategies, expert investment planning advice, employee benefit schemes, and both individual and corporate protection.

Paul has 35 years experience in the financial services industry. He’s a Fellow of The Chartered Institute of Bankers (FCIB). Paul also gained an MBA from The University of Hull.

Contact Paul now for an informal initial conversation with no obligation.

Call Paul: 07593 754 093

Email Paul: paul.wildman@sjpp.co.uk

LinkedIn: https://www.linkedin.com/in/paulwildman/

About the conversation:

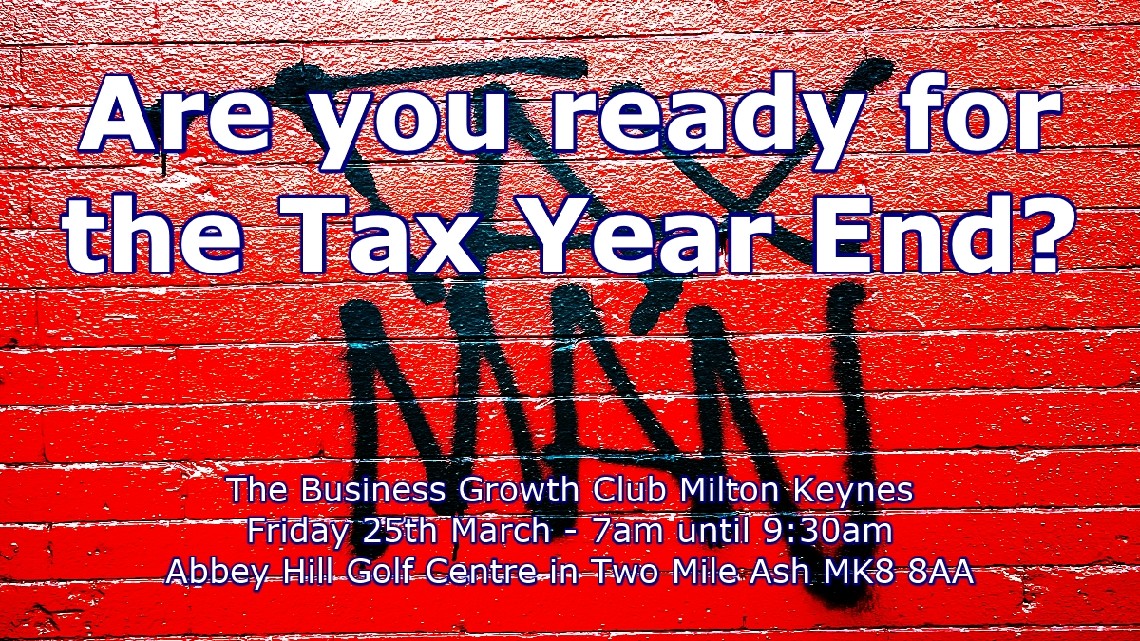

Tax Year End – know your annual allowances – use them or lose them

The tax year end on the 5th April is fast approaching. Do you really know what you can and can’t do to reduce how much tax you pay? It may not be too late… yet.

People with a vested interest will tell you that “buy to let” (BTL) investments are best for you. Others will recommend an Individual Savings Account (ISA). What about your Pension? Is that your best investment? Should you be doing all 3?

Paul Wildman, a Financial Adviser with MWealth will help you answer all these questions and more.